The African Continental Free Trade Area (AfCFTA) is a free trade area, outlined in the African Continental Free Trade Agreement among 54 of the 55 African Union nations. The free-trade area is the largest in the world in terms of participating countries since the formation of the World Trade Organization. Nigeria and Benin were the hold outs until July of 2019.

The agreement was brokered by the African Union (AU) (With a lot of help from China) and was signed on by 44 of its 55 member states in Rwanda on March 21, 2018. The agreement initially requires members to remove tariffs from 90% of goods, allowing free access to commodities, goods, and services across the continent.

As the tariff war between the U.S. and China drags on (Phase One now blessed), and manufacturing options like Vietnam and Indonesia are nearing peak capacity, China has looked to both Latin America and Africa for aggressive growth. In fact, China has now surpassed the U.S. as Africa’s largest trading partner. This didn’t happen within a short period of time, as they have been investing heavily in the infrastructure of the continent over the past couple decades. In fact, China is also now the single largest financier of African infrastructure, financing one in five projects and constructing one in three.

Of course, China isn’t the only country involved in the African continent’s progression, as the U.S. and the U.K. have been major financial backers over the years. Prime Minister Boris Johnson recently hosted the first ever UK-Africa Investment Summit in London, where he made the case for the UK as the ‘investment partner of choice’ for African countries. Heads of state from 21 African nations and their delegations assembled in London in addition to U.K. politicians, African entrepreneurs, and representatives from finance, business, and development. The result, the U.K.-Africa Investment saw a ($2.6 billion U.S.) worth of investments committed to African businesses over the next two years from the United Kingdom government’s development finance institution. As part of this success story, the U.K. noted that 16 African leaders attended the summit in London, including the leaders of Nigeria, Congo, Kenya, Egypt, Ghana, Senegal, Malawi, Mozambique, Ivory Coast, Uganda and Rwanda. Note: Dozens of African leaders had attended the Russian summit the year prior.

The competition is getting heated, as Africa’s economic potential has grown exponentially, now possessing eight of the world’s 15 fastest growing economies and a population on target to double to over 2 billion by 2050. The U.K. government is positioning itself as the “lead financier” via statements like “The UK is home to some of the world’s “most enterprising technologies” and is perfectly placed to meet that demand and be the continent’s investment partner of choice.” However, the actual numbers play a different tune. The U.K.’s department for international trade reported that two-way trade with Africa in the year ending in the second quarter of 2019 was $46 billion. Meanwhile, Africa’s two-way trade with China, the continent’s top trading partner, was $208 billion in 2019. Yep.

This is no new tale to tell, as China obviously has the financial resources to take over the world. Question is, who else is in this race? What about the U.S.? Well, South Africa is the largest U.S. trade partner in Africa, with a total two-way goods trade of $14 billion in 2018. Overall though, trade numbers are down. South Africa’s trade with the United States was $11.97 billion through the first 11 months of 2019, according to a WorldCity analysis of latest U.S. Census Bureau data. That’s 4.51 percent below its total trade during the same time period last year. U.S. exports to South Africa decreased 3.86 percent while U.S. imports from South Africa fell 4.95 percent. The U.S. deficit with South Africa was $2.24 billion.

On the bright side, approximately 600 U.S. businesses operate in South Africa, many of which use South Africa as regional headquarters. South Africa qualifies for preferential trade benefits under the African Growth and Opportunity Act as well as the U.S. Generalized System of Preferences trade preference program. Both governments engage in frequent discussions to increase opportunities for bilateral trade and investment and optimize the business climate. The United States and South Africa signed an amended Trade and Investment Framework Agreement (TIFA) in 2012. In addition, the country belongs to the Southern African Customs Union, which signed a Trade, Investment, and Development Cooperative Agreement (TIDCA) with the United States in 2008. The United States and South Africa have a bilateral tax treaty eliminating double taxation.

What about other countries investing in Africa as the new frontier in trade?

Ernst & Young released the ninth edition of the Africa Attractiveness report, which outlines trends and opportunities in Africa’s economic growth and foreign direct investment (FDI) to the continent.

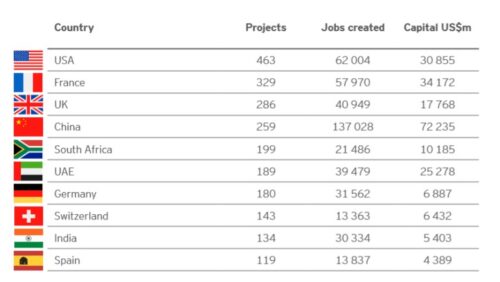

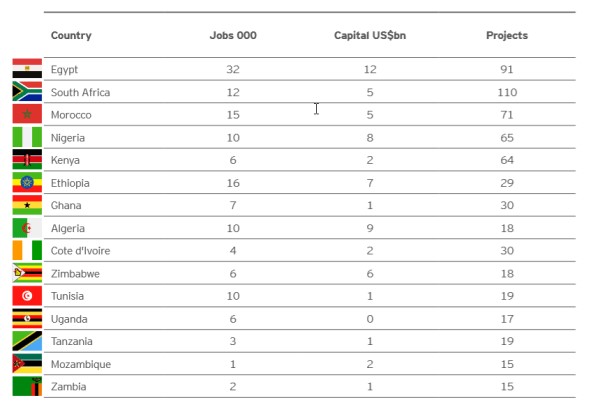

There are a couple of very interesting graphs in the report. They display that the largest investors by number of projects in Africa were the United States, France, and the United Kingdom, respectively. However, China was the largest investor in terms of total capital, investing more than twice the dollar amount of France or the U.S. The report states that FDI that flows from traditional investors is driven by strong historical relationships: France, for instance, is a key investor in francophone Africa. Other emerging partners, like the United Arab Emirates (UAE), and India, are playing an increasingly important role in Africa, accounting for 34 percent of total projects and over 50 percent of jobs created and capital investments. Additionally, intra-African investment continues to grow. South Africa remained the most extensive investor in other African countries, and Kenya and Nigeria contributed significant FDI to East and West Africa respectively. Egypt and Morocco are major investors in North Africa.

Figure 1: FDI 2014-2018 by source

Source: FDI Intelligence and EY Africa Attractiveness Report, 2019.

Figure 2: Largest recipients of FDI in Africa, 2018

Source: FDI Intelligence and EY Africa Attractiveness Report, 2019.

Observing all this investment, and perceived ROI, what is one of the biggest drawbacks? Qualified workers. It was 2016 when I attended an economic conference on world trade (textiles) in Hong Kong that was attended by some of the largest shoe manufacturers in the world (like NIKE) and was therefore visited by the KNCCI , the Kenyan National Chamber of Commerce and Industry. During their discussion regarding manufacturing in Africa, the elephant in the room seemed to be, could Africa overall improve its labor force to catch up with manufacturing in places like Vietnam, Indonesia, Thailand, which have become options for many companies now caught in the U.S. vs China tariff war.

It just so happens that Africa’s governments are working to develop not just the required infrastructure, but also the institutions. Across the continent, efforts are underway to improve education. It’s an ambitious plan, with a long way to go since at a glance South Africa’s unemployment rate increased to 29.10 % in Sep 2019, from the previously reported number of 29.00 % in Jun 2019. Wrong direction. Right now, only 44% receive a grade high enough to enter a Bachelor program at one of the universities in S. Africa.

This essential steady flow of qualified workers into new formed factories is a huge issue on the continent. Taking a step to rectify this, China has been particularly proactive in deepening its links with Africa, including by investing in the continent’s industrialization, inclusive of education. With China projected to shift 100 million labor-intensive manufacturing jobs offshore by 2030 , these are jobs that Africa’s large and young workforce could potentially fill. What happens in this time period could be a huge boost for Africa. Here is a link to the top 200 universities in Africa: https://www.4icu.org/top-universities-africa/

In the meantime, on the investment front, Africa has also pursued partnerships with emerging economies like India, Indonesia, Russia, and Turkey. Outside looking in, in this blueprint for rapid growth the African governments must be aware of both the pros and cons of new trade deals and financial agreements with these emerging economies, especially China. Many economic experts are cautioning Africa regarding the amount of control China will ultimately have in its growth and subsequent direction. Nonetheless, from the origination of the pact, China was a major broker in the AfCTFA, and that influence was well earned, and has not lost momentum.

In the big picture, last year, economic growth slowed in all geographic areas except Africa, as per the United Nations report recently in its annual World Economic Situation and Prospects 2020. The U.N. said gross domestic product growth in Africa is projected to reach 3.2% in 2020 and 3.5% in 2021. 25 African countries are projected to achieve economic growth of at least 5% this year.

It will be interesting to see how the very competitive investment scenario plays out within the next 10 years. At the current rate, those African youth who can take advantage of the increased investment within the educational system should strongly consider learning Mandarin.